Phoenix Part 2 – A Closer Look at HonorHealth

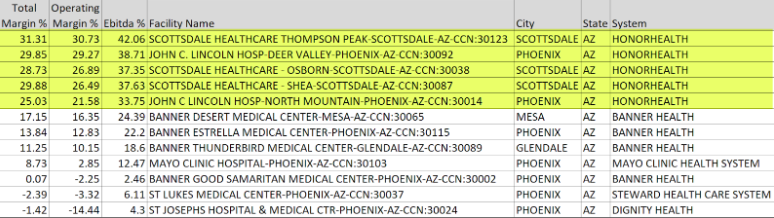

In our part 1 of Phoenix: A Race to the Bottom, we noted that outside of the downtown proper was a NFP system, HonorHealth that was very profitable.

Looking further, Honor Health is a standout on any measure of profitability at each of their facilities when compared to all the other 101 Ring facilities around Phoenix. This is also true if you broaden the radius to include the 22 facilities in the bigger 303-101-202-10 loop. Remarkably, the HonorHealth facilities have very consistent margins among all their facilities.

This, in spite of the fact that HonorHealth facilities significantly lag the occupancy rate of the loop facilities. To their credit, HonorHealth’s Overhead costs (not shown) are better than Banner and Steward facilities.

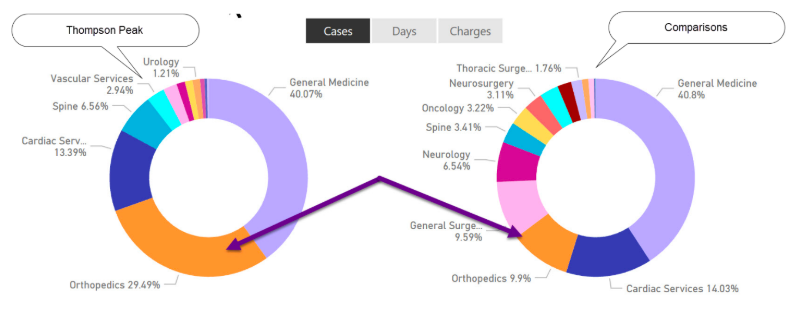

Looking at Service Line Comparisons is quite revealing. The numbers below are Medicare numbers for all facilities. We’ll compare HonorHealth’s Thompson Peak (left donut in both charts below) to the non-HonorHealth comparison facilities (right donut.)

When looking at cases, we can see that HonorHealth’s facility has a significantly more important Orthopedics practice than comparisons.

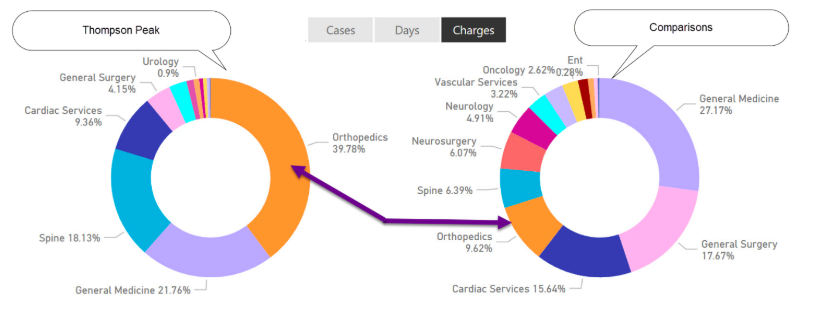

But compare that to Charges (shown below) and you’ll see an even larger difference.

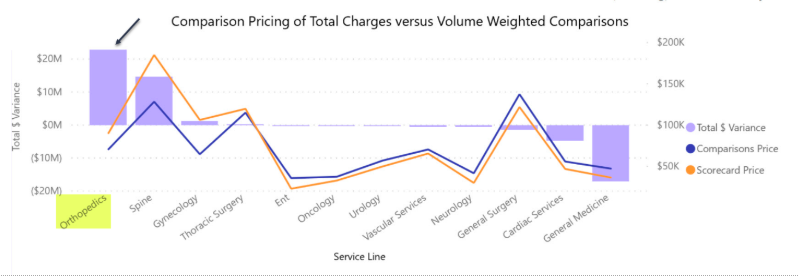

It appears that Charges submitted to Medicare are some $20M higher for the Thompson Peak’s cases than for comparison facilities. While not actual payments, it does indicate that a significant part of HonorHealth’s margin success is likely Orthopedics pricing.

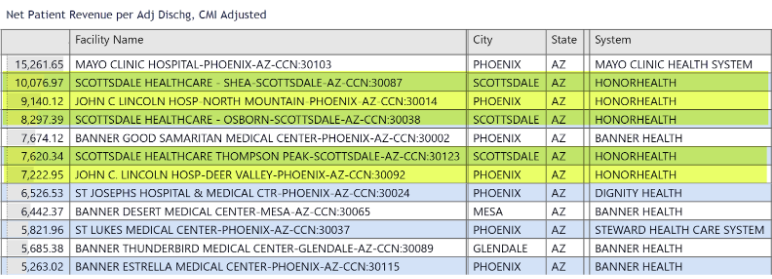

In addition to charges, overall pricing (all payers, all cases) appears to be “effective” as well with 5 of the top 7 spots held by HonorHealth.

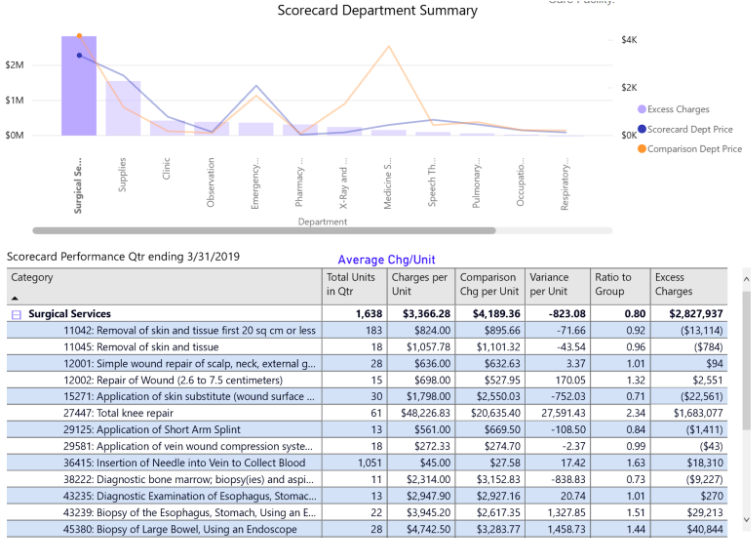

Beyond Inpatient pricing, Outpatient pricing is also higher than comparison facilities, especially in Surgical Services as shown below. (Note also, though not shown, HonorHealth has aggressive markup ratios versus comparison facilities.)

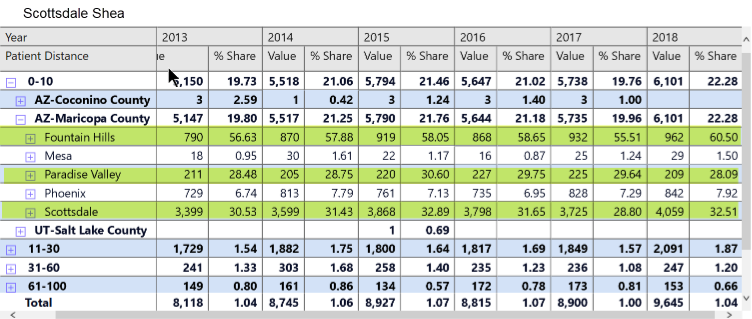

What makes this possible? Well, let’s look at market share close to home (2018 Medicare data). The HonorHealth Scottsdale facilities have a very strong share in their local market with the Scottsdale facilities and particularly Shea (shown below) clearly dominating their market. Though the John C. Lincoln facilities are not as dominant, it does point to a strong price negotiation position for the system.

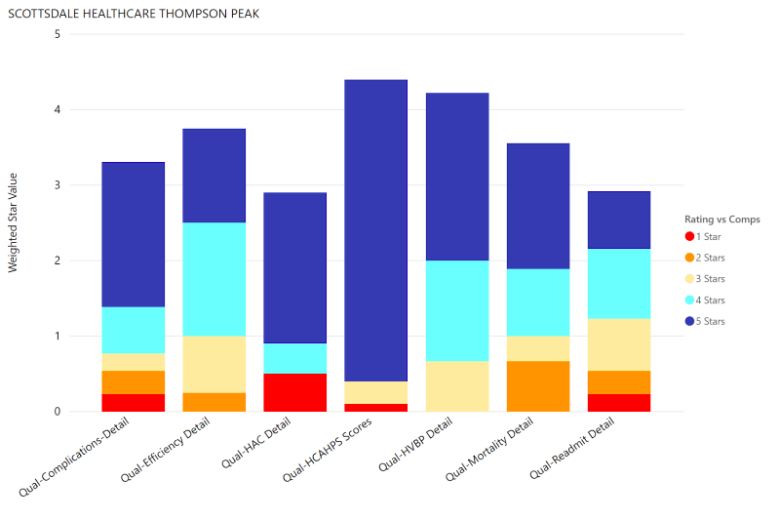

And as an aside, their Quality profile looks pretty strong—nothing to prevent a payor from wanting them in their network. For example, the Scottsdale facilities in Thompson Peak, Shea, and Osborn are above average in most categories (see Thompson Peak below).

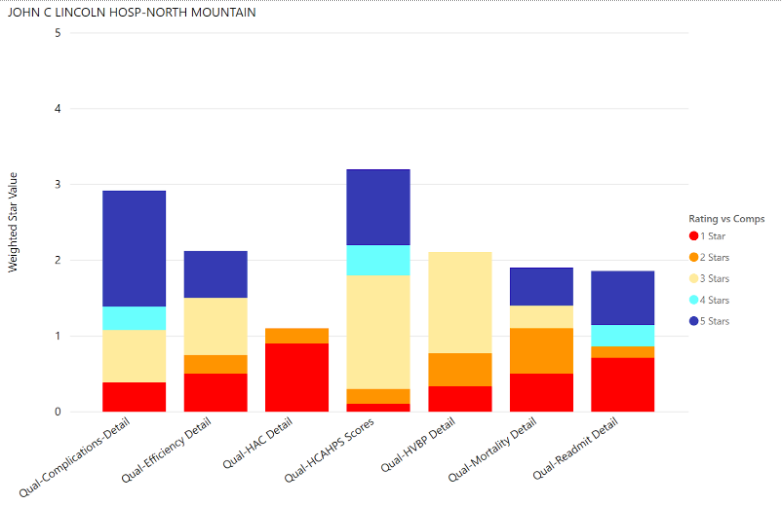

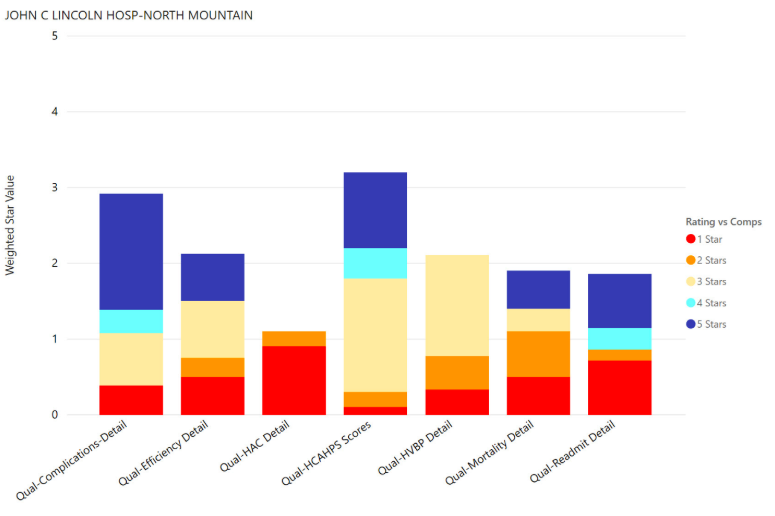

That said, the John C. Lincoln facilities have significant risk associated with them—being below average in HACs, Mortality, Readmissions, and Serious Complications metrics versus these comparisons. Their HCAHPS scores are their best category, so patients do like the experience despite the risk. See below:

All in all, HonorHealth is very strong, manage overhead well, monetize their market strength in Scottsdale and East Phoenix and have significant Orthopedics work. Noteworthy, though, the John C. Lincoln facilities have some quality issues and are showing signs of market share weakness.

That’s it for a 30-minute run through. There is much more that could be done, but we can see a pretty good picture of the market and HonorHealth’s success and strategy from which to continue to drill down, understand, and make decisions around. Who wouldn’t want to see these actionable insights about any system in any US market?